Georgia payroll tax calculator 2020

This guide is used to explain the guidelines for Withholding Taxes. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and.

Income Tax Calculator 2021 2022 Estimate Return Refund

Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax.

. In the field Number of Payroll Payments Per Year enter 1. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Payroll Tax Salary Paycheck Calculator Georgia Paycheck Calculator Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried.

Optional Select an alternate tax year by default the Georgia Salary Calculator uses the 2022 tax year and associated Georgia tax tables as published by the IRS and Georgia State Government. In the income box labelled 1 enter the annual salary of 10000000. The Georgia State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Georgia State Tax CalculatorWe also provide State.

Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia paycheck. Free Unbiased Reviews Top Picks. This includes tax withheld from.

Payroll processing doesnt have to be taxing. 2022 Employers Tax Guidepdf 155 MB 2021 Employers Tax Guidepdf 178 MB. To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

How to Calculate 2020 Georgia State Income Tax by Using State Income Tax Table 1. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Find your income exemptions 2.

The tax calculator will automatically calculate the. After a few seconds you will be provided with a full breakdown. Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull.

Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. Find your pretax deductions including 401K flexible account. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and.

Ad Process Payroll Faster Easier With ADP Payroll. Content updated daily for ga payroll calculator. With just a few clicks the Gusto Georgia Hourly Paycheck Calculator shows you how payroll taxes are calculated.

Ad Compare This Years Top 5 Free Payroll Software. This 1099-G form is for. Ad Process Payroll Faster Easier With ADP Payroll.

Payroll Taxes Taxes Rate Annual Max. Discover ADP Payroll Benefits Insurance Time Talent HR More. The next step in determining payroll taxes in Georgia is to calculate Federal income tax.

Taxpayers now can search for their 1099-G and 1099-INT on the Georgia Tax Center by selecting the View your form 1099-G or 1099-INT link under Individuals. Get Started With ADP Payroll. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Ad Looking for ga payroll calculator. Rates include an administrative assessment of 006. All you have to do.

Latest payroll taxes rates and related laws for the state of Georgia. Georgia Salary Calculator 2022 Calculate your income tax in Georgia salary deductions in Georgia and compare salary after tax for income earned in Georgia in the 2022 tax year using. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. Georgia new employer rate. Get Started With ADP Payroll.

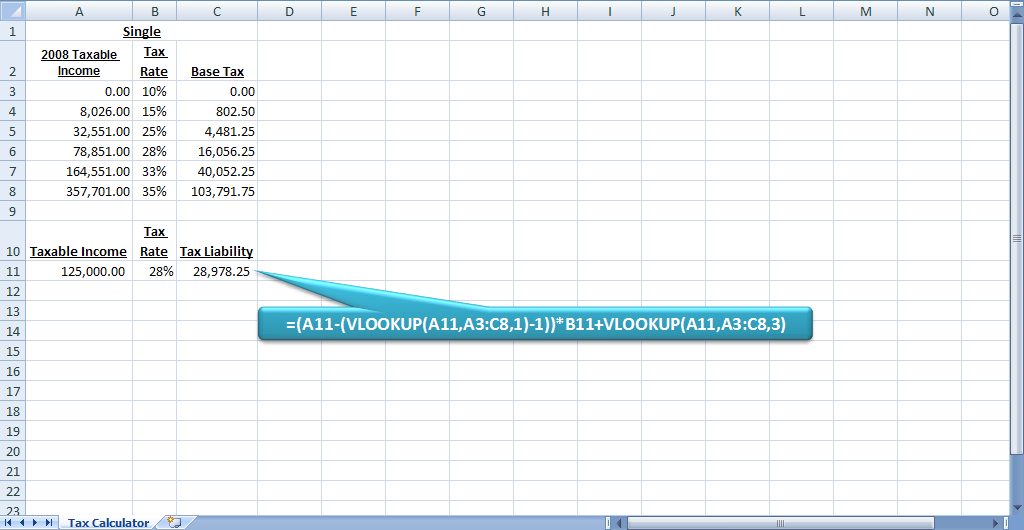

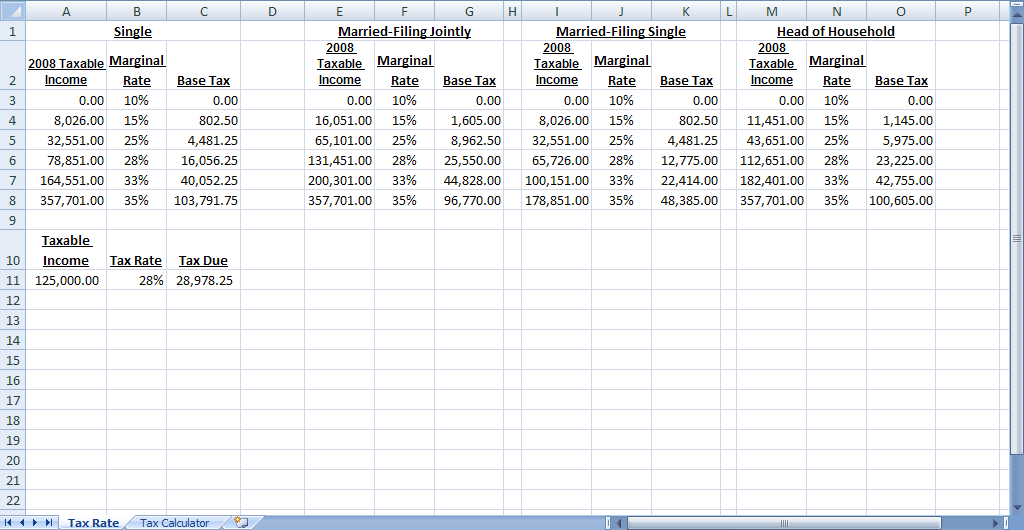

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Llc Tax Calculator Definitive Small Business Tax Estimator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Paycheck Calculator Take Home Pay Calculator

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

How To Calculate Payroll Taxes For Your Small Business

How To Calculate Payroll Taxes For Your Small Business

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

Payroll Tax What It Is How To Calculate It Bench Accounting

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Payroll Taxes

Payroll Tax Calculator For Employers Gusto

Georgia Paycheck Calculator Smartasset